How Soon Can I File Chapter 7 Again?

How Soon Can I File Chapter 7 Again? If you have already filed Chapter 7 some time ago and you’re wondering “How soon can I file Chapter 7 again?” this article will help answer the question. The...

Chapter 7

Read moreChapter 11 Bankruptcy In NC

Chapter 11 Bankruptcy In NC A Chapter 11 bankruptcy is a way to reorganize your business debt while continuing to do business. Chapter 11 enables you to continue your livelihood without the constant t...

Bankruptcy

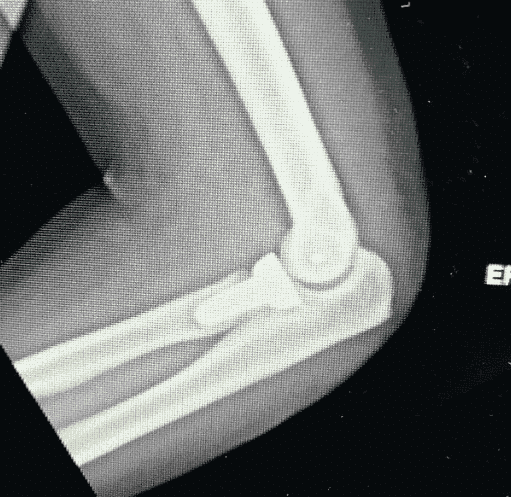

Read moreFractures From Car Accidents

Fractures From Car Accidents Some of the most common personal injuries are fractures from car accidents. The impact of the accident, combined with the physical contact with the interior of the body of...

Personal Injury

Read moreCharlotte, NC Personal Injury Attorney For Car Accidents

Charlotte, NC Personal Injury Attorney For Car Accident If you’ve been in a car accident in Charlotte, NC, you should call a Charlotte personal injury attorney. The call is free and it’s important...

Personal Injury

Read moreHow Much Is My Car Accident Worth?

How Much Is My Car Accident Worth? If you’re wondering “How much is my car accident worth?” the answer is… it depends. Yes, it’s a typical personal injury lawyer answer. But there’s a good...

Car Accident

Read moreThis Halloween Protect Yourself From Scary Personal Injury Insurance Adjusters

Happy Halloween! Remember, in the personal injury world, it's SCARY out there. Personal injury adjusters are not your friend. They are looking for ways to deny or de-value your car accident or slip an...

Personal Injury

Read moreWho Will Notify My Creditors About My Bankruptcy Filing?

This video helps you understand how your creditors are provided notice about your bankruptcy filing. The Layton Law Firm PLLC routinely represents bankruptcy clients in Chapter 7 and Chapter 13. Who...

Bankruptcy

Read moreSears Filed Bankruptcy – Should You?

Sears Filed Bankruptcy – Should You? News today made it very clear that Sears filed bankruptcy. As a bankruptcy law firm, any time we see a corporation filing bankruptcy, we know it’s a business d...

Bankruptcy

Read moreHow Much Do You Get For Pain And Suffering?

How Much Do You Get For Pain And Suffering? If you’re wondering how much do you get for pain and suffering in a personal injury settlement, you’re not alone. This is one of the most important conc...

Personal Injury

Read moreBankruptcy And Gifts

Bankruptcy And Gifts This article will discuss both the giving of and the receiving of gifts in bankruptcy. If you’d like to speak with a bankruptcy attorney today, call 704.749.7747 or click to req...

Bankruptcy

Read more