Commercial Vehicle Accidents And Personal Injury

If you’re involved in a car accident with a commercial vehicle, chances are you have a serious injury. The increased size and weight of commercial vehicles make car accidents more severe than most c...

Personal Injury

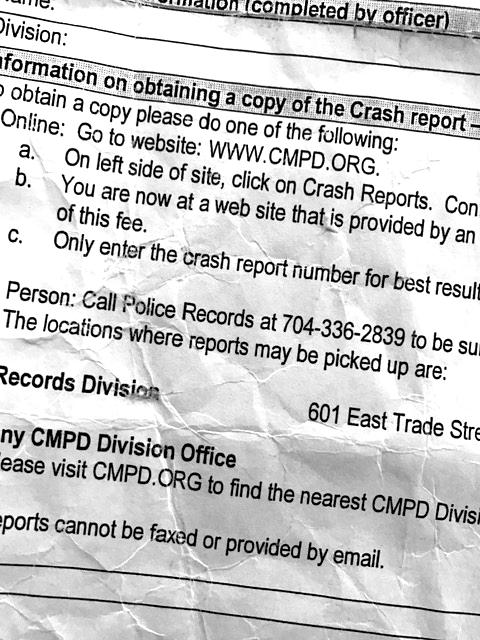

Read moreCharlotte Auto Accident Crash Reports

When you’re in a car accident in Charlotte, North Carolina, you’ll most likely be given a Crash Report Exchange Slip by the attending officer. This form is meant to provide basic information about...

Personal Injury

Read morePaying For Your Charlotte Bankruptcy

I speak with clients every day who want to file a Chapter 7 bankruptcy in Charlotte, NC but don’t have the money in hand to pay an attorney. That’s one of the challenges of paying for your Charlot...

Bankruptcy

Read moreAverage Auto Accident Settlement In Charlotte

The average auto accident settlement in Charlotte, NC depends on many factors. In considering the value of your auto accident claim, the insurance adjuster and your personal injury lawyer will negotia...

Personal Injury

Read moreTips For A Passenger In A Car Accident

If you are a passenger in a car accident, there’s a helpless feeling that comes along with it—you had nothing to do with whether there was an accident or not. You weren’t driving the vehicle you...

Personal Injury

Read morePassenger In A Car Accident

If you are a passenger in a car accident in Charlotte, North Carolina, you are in a unique position. Essentially, the accident wasn’t your fault. This eliminates the question of liability, which pla...

Personal Injury

Read moreCharlotte Personal Injury Lawyer Reviews

Prior to hiring a Charlotte personal injury lawyer, you should do some homework, including reading Charlotte personal injury lawyer reviews. While there may be a personal injury review that is unrelia...

Personal Injury

Read moreHappy (and safe) Halloween!

Halloween is a great time to be a kid. The thrill of running house to house for free candy is tough to beat. During trick or treating, you’ll see exhausted parents who would have given up hours ago ...

Personal Injury

Read moreWater On The Bathroom Floor

It amazes me how often I enter a Charlotte restaurant bathroom to find there is water on the bathroom floor. It is usually easy to tell if the wet floor has just been mopped, or if the water on the ba...

Personal Injury

Read morePedestrian Right Of Way In North Carolina

Pedestrian right of way is something most of us feel comfortable with. We all grew up with the understanding that “The pedestrian always has the right of way.” In most people's minds, this maxim a...

Personal Injury

Read more