What Happens To My Car In Bankruptcy?

If you own a car or lease a car, you will need to decide what happens to your car in bankruptcy. You have the choice to keep your car and the debt associated with it, or you can choose to surrender th...

Bankruptcy

Read moreThe Personal Injury Consultation

If you are looking for a personal injury lawyer in Charlotte, NC, we can help. Our firm has helped countless individuals who have been injured in car accidents, pedestrian accidents, and grocery store...

Personal Injury

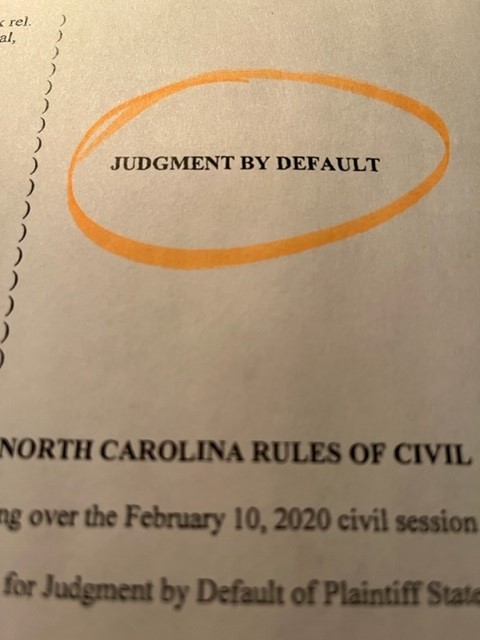

Read moreDefault Judgment – What To Do

If you received notice of a default judgment, it most likely means that a creditor successfully filed a lawsuit against you and obtained the judgment in your absence. This judgment is just as valid as...

Bankruptcy

Read moreCase Law Update – Contributory Negligence

Case Law Update – Contributory Negligence North Carolina is one of the only states remaining which embraces the concept of contributory negligence. Essentially, this means that a jury will be instru...

Personal Injury

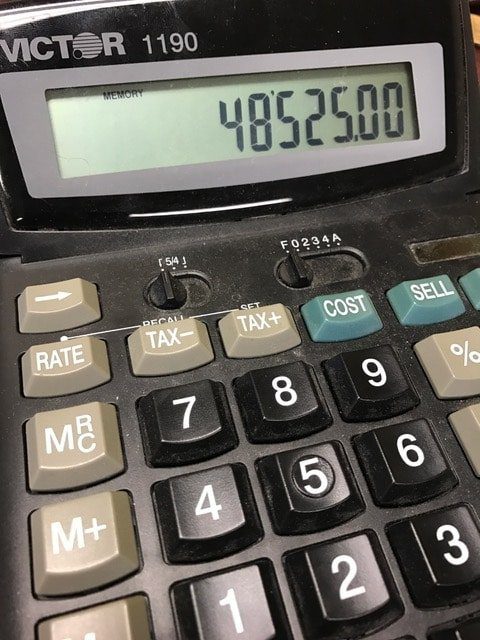

Read moreBankruptcy Filings Increase 10% In August

Bankruptcy filings for all Chapters (Chapter 7, Chapter 13, Chapter 11) increased in July of 2022, as compared to July of 2021. A recent article by Epiq Bankruptcy indicates that increased interest ra...

Bankruptcy

Read moreHard Money Lenders And Debt Settlement

Debt Settlement With Hard Money Lenders Hard money loans serve a very specific purpose and fall under alternative lending. They provide cash quickly. Typically, they are used for a real estate investm...

Bankruptcy

Read morePower of Attorney for Elderly Parents

If you are considering a power of attorney for elderly parents, you are most likely balancing your concerns for your parents against the concern for granting someone a power of attorney. If you are a ...

Estate Planning

Read moreFree Consultation Charlotte Personal Injury Lawyer

Free Consultation Charlotte Personal Injury Lawyer If you need a consultation with a Charlotte personal injury lawyer, you are a few minutes away from speaking with a Charlotte personal injury lawyer....

Personal Injury

Read moreHow Much Debt Do You Need To File Bankruptcy?

How Much Debt Do You Need To File Bankruptcy? There is no set amount of debt needed to file bankruptcy. In deciding whether to file bankruptcy, we examine the amount of debt you have, the type of debt...

Bankruptcy

Read moreAuto Accident Settlement Timeline

Auto Accident Settlement Timeline First, if you would like to speak with someone about an auto accident settlement timeline, we are here to help. Simply call 704.749.7747 or click HERE to request a ca...

Car Accident

Read more